Eliminate fraud bad debt

Looking for a safer way to broker deals?

We understand the risks that intermediaries take to connect quality products and services with legitimate buyers and sellers. Facing the constant threat of being circumvented and navigating the risks of fraud, corruption and bad credit takes its toll!

Convert third-party sales with confidence

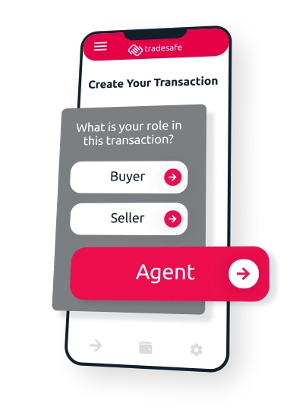

How it works

TradeSafe’s escrow protects buyers and sellers by holding the buyer’s funds in an escrow holding account until the seller delivers the goods or fulfils their obligations. Buyers get what they paid for, and sellers are guaranteed payment.

Buyer and seller agree on the terms of the deal

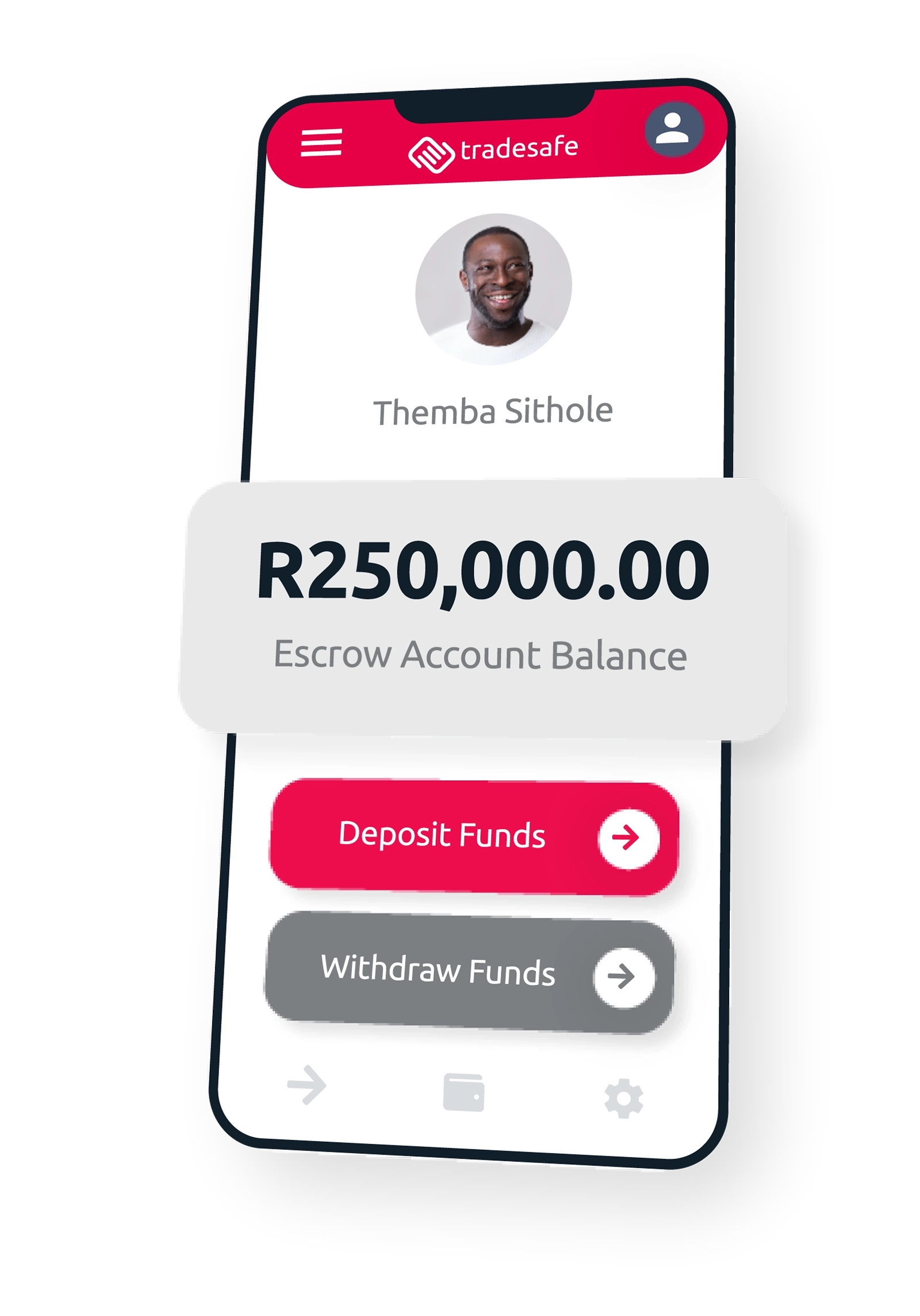

Buyer deposits funds with TradeSafe

Once both the buyer and seller have agreed to the terms of the deal, the buyer will deposit the funds in full with TradeSafe. The seller will receive a signed letter of comfort.

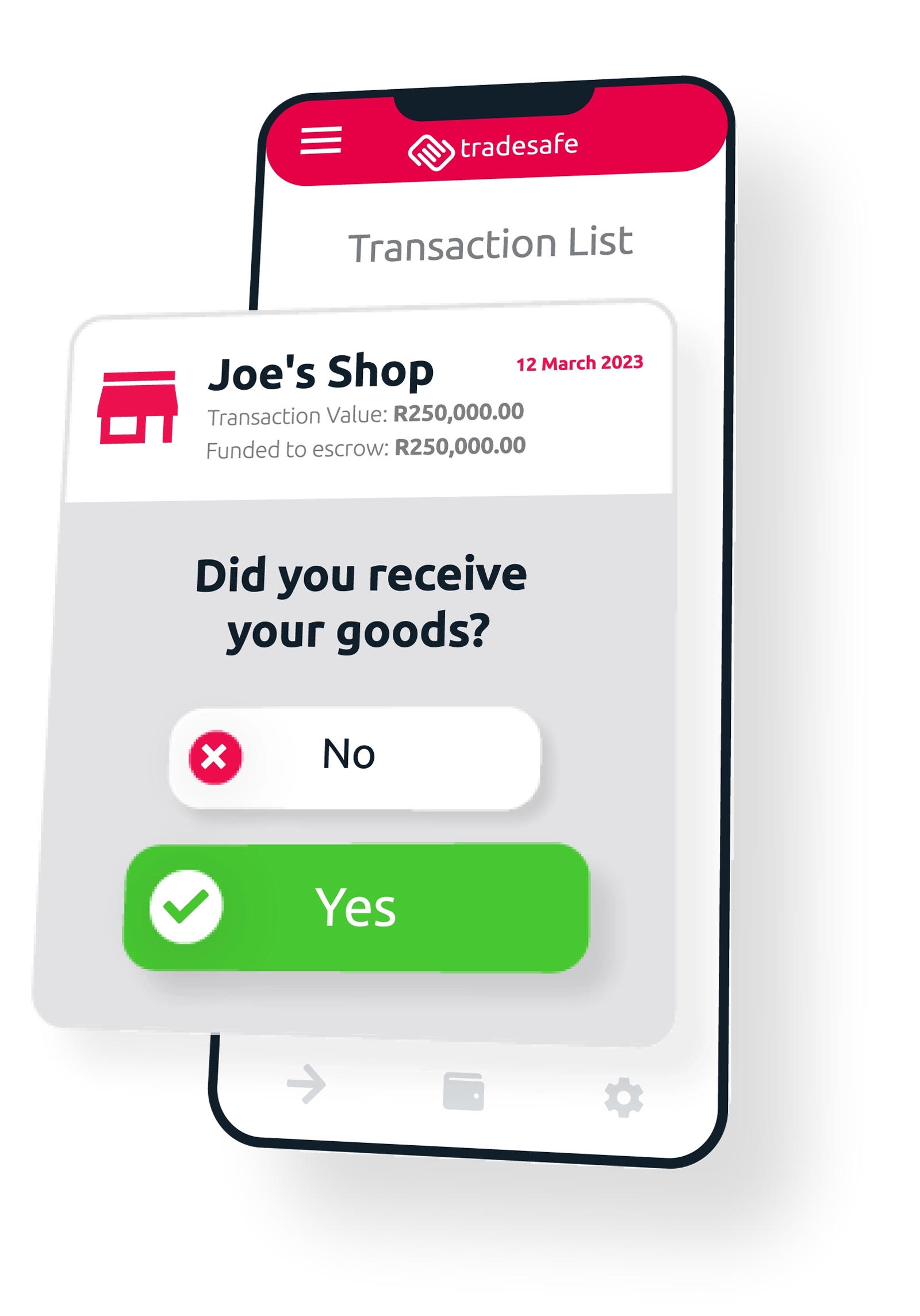

The seller delivers the goods or services

Knowing that the funds are safe with TradeSafe, the seller can confidently deliver the goods or services to the buyer. Courier or tracking information can also be uploaded.

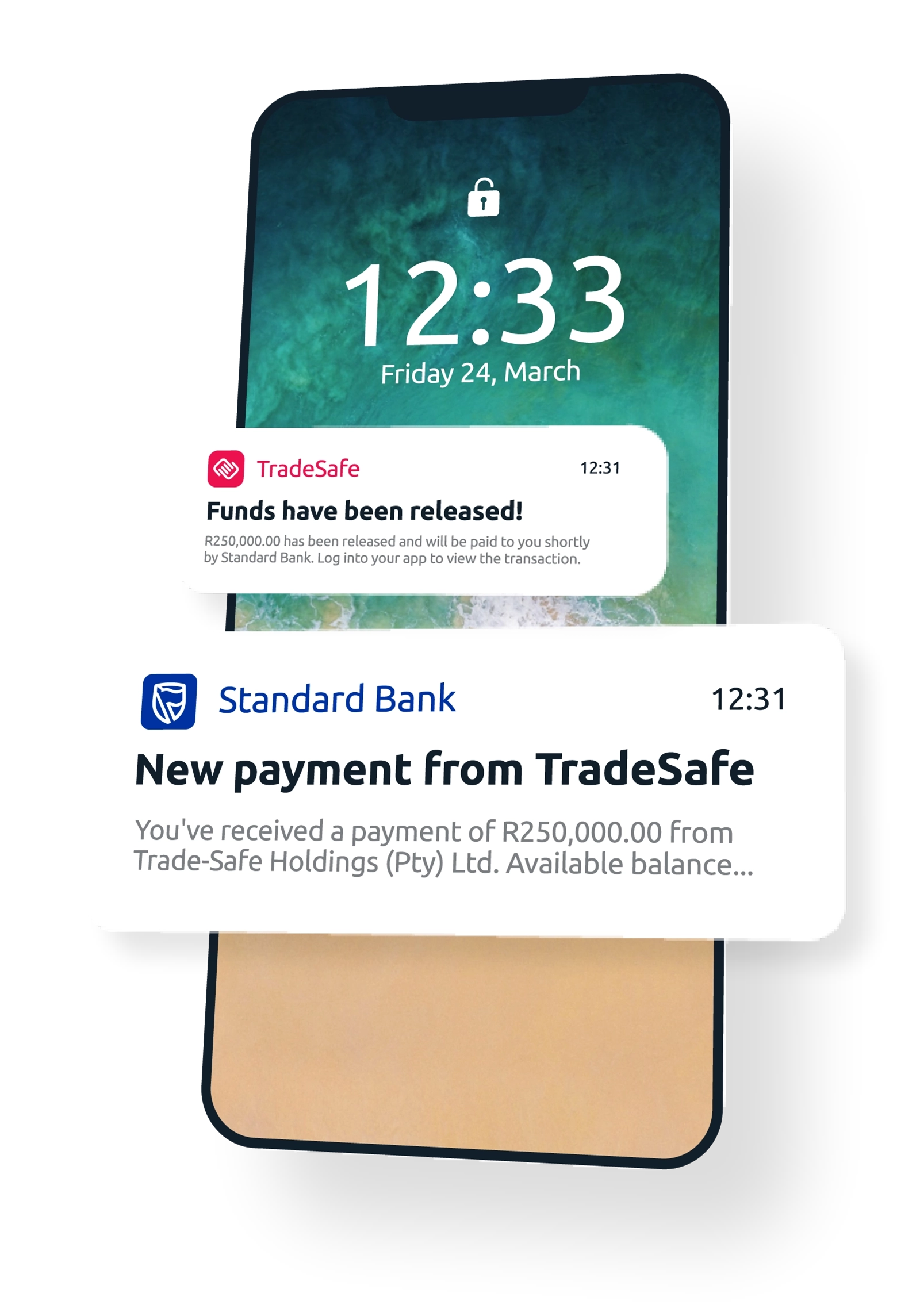

Tradesafe instantly releases payment

Grow your agency with escrow

TradeSafe removes the risk of handling other people’s money when brokering a deal between two parties. Now you can ensure that your buyer receives what they pay for, and everyone gets paid in full.

Individuals

Businesses

Sell with Standard Bank-supported escrow to enjoy upfront confidence in your buyers and eliminate the stress of not being paid.

Beat the risk, with TradeSafe

TradeSafe is South Africa’s longest-running digital escrow service, protecting businesses and individuals from transactional fraud and bad debt.

million

in transactions processed across 40 industries

years

as the longest running escrow provider in Africa

merchants

using the TradeSafe merchant integration

Bank-supported

Insured

Audited

Compliant

Your money has never been safer

From multi-million rand commodity deals to antiques, luxury timepieces and second-hand cars, TradeSafe has been protecting online transactions since 2015.

Say goodbye to scams, fraud and bad debt & sell with confidence

Whether you are transacting for yourself, your business, or your shop, Tradesafe is the safest way to transact online. Enjoy the freedom to transact without fear with TradeSafe’s bank-supported digital escrow service.